The company is useful for making international transfers and receiving cross-border payments at a lower cost compared to a traditional bank.

Those looking for multi-currency cards or expense tracking and management should opt for a provider like Wise Business, Airwallex, or Revolut.

Overview

Monthly Fee | Exchange rate | International transfer fees | Multi-currency account |

|---|---|---|---|

£49 / month + £95 signup fee | Agreed after sign up | From 0.55%, min £35 (SWIFT to 180+ countries) | 34 IBAN accounts |

Pros

- Payset offers access to IBAN accounts across and utilise both local and international payment options for each

- Accounts come with FX rate reports and alerts, allowing businesses to make decisions based on improving currency risk

- Automated payments to staff, including managing tax obligations, can be done within the account

Cons

- The monthly fee and minimum fee per payment make Payset more suitable to businesses with regular, slightly larger transactions

Features | Insight |

|---|---|

Bulk payments | Payset has recently released an updated version of the bulk payments system (not batch payments). With bulk payments, you can make multiple payments to anyone with a single transaction with all details uploaded through a CSV. |

Pay invoices | Possible to pay invoices and track payments within Payset at a lower rate than doing so through a bank |

Receive Payments | Payments can be received but are subject to a fee of 0.75%, or £12 as a minimum. This is not the case with most providers |

Marketplace integration | Payments can be withdrawn from marketplaces by adding an account, but no apps or integrations within Payset itself |

Multi-currency account offering

The main product offered by Payset is the multi-currency account.

They support 34 currencies across 180 countries and provide 6 domestic IBAN accounts (different from local accounts). This is lower than Equals Money (supports 38 currencies), Sokin (75+ currencies), and Wise (40+ currencies).

Check out the table below for more details and the breakdown.

Supported currencies

Payset offers only 6 domestic IBAN accounts (UK, US, DE, DK, IL, and EU) and no local accounts.

This means you will receive an IBAN to collect payments like a local account, avoiding some transfer fees. Unlike with local accounts, you get other bank details too (for example, account number and sort code in the UK).

This makes Payset's offering very light compared to Wise, which offers 10 local accounts, Airwallex, which offers 12 local accounts, and Payoneer, which offers 9 local accounts.

In addition, Payset offers free P2P transfers between Payset clients. This might be a good option if your business plans on using multiple accounts, or on-board clients and setting them up with their own accounts.

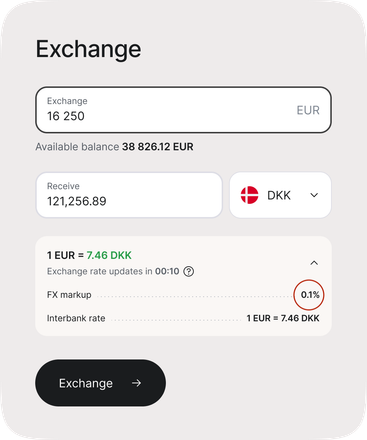

Currency exchange

Although this is tightly linked to multi-currency accounts, Payset has built a set of tools for currency conversion.

The exchange rates they offer are clearly visible before making a conversion and can be used to make cross-border payments or to hold currencies in the account.

There is no limit on how much you can convert, which is the same as OFX for example.

One great feature they have is their granular FX reporting system, with breakdowns of each transaction, account management features based on the amounts, accounting tools, and more.

This makes Payset a decent choice for those who need advanced reporting but are happy to pay higher fees for it.

Transfer systems and networks

Currently, Payset supports 7 transfer systems to accommodate their list of countries to make international and domestic payments. These are:

SWIFT

SEPA

FPS (Faster Payments)

CHAPS

ACH

BACS

TARGET 2

Fees

Payset fees are relatively high considering they only offer currency exchange and a multi-currency account.

A monthly fee starting at £49 vs no monthly fee with Sokin or TorFX, which both have increased features, puts them at a disadvantage in the market.

Currently (until October 31st, 2025) you can get 3 months of no commitment for free followed by the usual £49/month. With this, you are effectively paying £40/month, which is still high compared to similar platforms.

In terms of transparency, they do not state their markup or fees.

It is only calculated before the conversion takes place and the received amount is clearly visible before you hit the "Exchange" button.

Ideally, this information should be available before you even sign up (this is how Wise does it for example), but considering the rates are tailored to each customer it might be difficult.

Service | Price |

|---|---|

Account Opening | From £95 |

Monthly Fee | From £49 |

Receiving Money | Free (local) / International from 0.75% (£12 min) |

Sending Money | Local transfers from 0.45% (£8 min) / International transfers from 0.55% (£35 min) |

Currency Exchange | On request |

Extras | Account reactivation from £250 / Dormant account fee from £100 / Additional accounts from £100 per account |

Speed and limits

There are no holding or transaction limits on cross-border payments with Payset. You can transfer or exchange as much as your business needs.

As for the transfer times, this will depend on the amount transferred, the currencies involved, and the way the money is sent. Here’s a rough breakdown of the transfer times:

Transfer type | Payset transfer speed |

|---|---|

SWIFT | Up to 2 business days |

SEPA | Up to 2 business days |

Faster Payment System (FPS) | Up to 4 hours |

CHAPS | Up to the end of the business day |

ACH | Up to 3 business days |

BACS | Up to 3 business days |

Target 2 | Up to 2 business days |

Legitimacy

Payset started as a cryptocurrency company in 2017 and later pivoted to online payment systems and cross-border solutions.

In 2022 Payset partnered with the Thought Machine to power their services, the same company that offers services to SEB bank, Standard Chartered, BPIFinance, Lloyds Banking Group, and many more.

Payset is based in London, UK, and is approved by FCA to conduct cross-border transfer (900920) and is a registered company by HMRC (11529161).

Payset is not FSCS-protected as it is not a bank.

Instead, they hold e-money licenses, meaning your business's money is safeguarded (held in separate accounts to the company).

Eligibility

Business types

Countries

Products offered by Payset

Signing up for Payset

The signup process only involves a few steps. Once you submit your information, it can take 48-72 hours for it to be reviewed.

Follow the steps below to get started.

Start the Registration Process

Visit the Payset website and click on the "Get Started" button on the homepage. From there, select Business account.

Submit Your Information

Fill in your company details, including business type, operating regions, and estimated turnover. Be prepared to upload supporting identity and registration documents as part of the KYC/KYB process.

Complete Onboarding

Use the self-service onboarding system, which typically completes account approval within 48 hours. Payset may request additional information to finalize the process.

Account Setup and Fees

Pay the account setup fee (from £95), which varies based on your company details. Once approved, you'll receive confirmation of your account details from the onboarding team.

Companies using Payset

Global pay roll

With Payset you and your business can pay staff across 180 countries, automate staff payments, have granular control and let staff members create their own accounts to make payments, as well as receive detailed business wide reporting.

Start ups

Start-ups will benefit from dedicated account managers to solve any issues and help with money transfers. In addition, your start-up will be able to make and take payments in different currencies (lowering the fees), benefit from fraud prevention tools, and make free P2P transfers between Payset accounts.

Affiliate providers

Affiliate providers will benefit from the pricing structure, which makes it easier to scale accounts up or down, automate payouts to affiliate partners, and let sub-affiliates create and manage their own Payset accounts. However, not every niche is accepted, so it’s worth contacting Payset in advance if unsure.

Marketplaces

Marketplaces and e-commerce businesses can take advantage of low deposit fees and ability to receive local payments in multiple currencies from customers all over the world.

B2B payments

Businesses focusing on B2B payments can take advantage of the simplicity of the platform. Many B2B companies still rely on cash and cheques, while Payset makes it easy to transition to an online payment system. With Payset, your business will be able to keep track of transactions with advanced reporting and receive payments over multiple networks from 180 countries.

Import/Export

Businesses working in the Import/Export sector will be able to make seamless payments in multiple currencies for pre and post shipping payments, and will benefit from fast transfer times.

You can learn more about the benefits of cross border payment solutions in the following guides:

.png)

.png)