The solution is largely API and custom-driven and can be used for regular incoming and automated payments like subscriptions, as well as for larger business payments.

The platform also allows businesses to create custom products for the end user, enhancing options for customer use.

Overview

Transaction fee (International) | Refund Fees | Settlement timeframe | International markets |

|---|---|---|---|

$2 for receiving international transfers | 1% | 2-3 business days | 240+ countries & territories |

Pros

- Experience and dedicated solutions for education, healthcare, travel and B2B industries

- Multiple integration with ERP & CRM systems, as well as API use for custom integration

- Real-time tracking for payments and invoices as well as live reporting

Cons

- Lack of transparency with exhcnage rates and fees compared to other payment solutions

Features | Insight |

|---|---|

Invoicing | Automate invoicing in multiple currencies |

Guest payments | Request payments from anyone with locked exchange rates |

Integrations | Multiple integrations ranging from embeds to checkouts |

Accounting and CRM integrations | Connects to multiple accounting applications and CRMs including Sage, Oracle Suit, Xero, and more |

Expertise | Years of expertise in education, health, travel, and B2B solutions |

Pay-by-Link | Request payments with a single link creating a seamless payment experience |

How it works

Flywire essentially connects your business to the payment processor and handles all the nuances in-between such as currency conversion and routing the money.

FOR EXAMPLE: BILLING CUSTOMER IN NZ FROM THE US

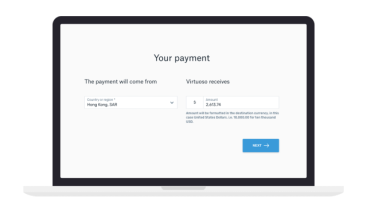

Here’s an example, let’s say you need to bill a customer in New Zealand for 10,000 USD, this is what it would like:

You bill your customer in USD

Customer in New Zealand pays the invoice in NZD via bank transfer (or any other method)

Flywire receives the payment and converts NZD to USD

Flywire takes off all the fees from the final amount

USD is now routed to you and deposited into your account

Fees

The total cost of using Flywire is difficult to give an accurate number on as every customer will require a custom solution. This being said there are a few areas of the offering that allow us to stack up the cost against others on the market.

Service | Fee |

|---|---|

Domestic fees | $0 but your bank might add additional charges depending on the transfer method. |

Price cap per transaction (domestic only) | Not applicable. |

Receiving international transfer | $2 |

Currency conversion rate | Competitive rates but vary by currency. |

Refund fees | 1% processing charge. |

Chargeback fees | Average out around $10 - $50 per chargeback. |

In general, with Flywire, you will be paying:

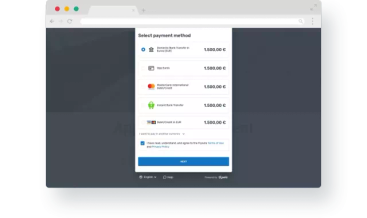

A transfer fee (domestic is free) - A fee charged for making an international transaction.

The exchange rate markup - A percentage added to the real exchange rate.

Convenience fee depending on the payment method used - Depending on the payment method, Flywire needs to cover their costs so they add this fee. For example, bank transfers have no fees for them so it’s cheaper, while card processing is more expensive for them and comes with convenience charges.

This makes Flywire a good choice for domestic transfers (which are free) since other platforms like GoCardless (1% + £0.20) and Rapyd (0.20%-1.80%) charge a fee.

On the other hand, GoCardless has lower refund fees ($0.50) and is more upfront and transparent with their international fees, which might be a better choice for marketplaces and online sellers who deal with more refunds.

Eligibility

Flywire has a strong presence in education, healthcare, travel, and B2B sectors. Most of their features are tailored to these industries.

If your business is not one of these, you can still contact their customer service as each business is handled individually.

But we would recommend finding another platform built with your industry in mind, such as Fondy, Zen, GoCardless, or Rapyd.

Business types

Countries

Legitimacy

Flywire was founded in 2009 and has since become a publicly traded company. Flywire serves over 4000 clients across 240 countries with offices around the world.

Flywire is registered or licensed as a payment company / Money Service Business (MSB) in:

The European Union via a Lithuanian license from the Bank of Lithuania

The UK (FCA)

the US (BSA and FinCEN)

Canada (FINTRAC)

Australia (AUSTRAC)

New Zealand (DIA)

Singapore (MAS)

As a publicly traded company handling money, they have to adhere to AML, CTF, and FATF standards.

Considering all the above, It is fair to say that Flywire is a legit and reputable company.

Products offered by Flywire

Global payment network

Flywire supports 140 currencies, covering more than 240 countries.

This is achieved via a network of partners and local accounts all over the world. This means, that when payments are taken, they are either done via their own accounts or companies they are partnered with.

Money is then added to one account and withdrawn from another, meaning money never crosses the borders and fewer fees are applied.

As a part of their network, Flywire is partnered with Mastercard, Visa, Venmo, Alipay, WeChat, Trustly, multiple banks, and other financial institutions.

This essentially allows businesses to take payments via multiple methods making it more convenient for the customer.

Integrations

Considering the broad reach and industry coverage, Flywire built a set of tools and integrations to fully customize the payment journey to your business needs. A few of the key integrations include:

Pay-by-Link

Checkout

API

ERP & CRM Systems

Pay-by-Link

This is a simple, PCI-DSS-compliant way to take payments.

It is a payment link that can be integrated anywhere your business operates, for example on your website, email, or invoice.

Once your client clicks on the link, it is automatically redirected to a payment page created by Flywire with all the details filled in for the client.

This information is then passed back into your Flywire account for automated updates, reconciliation, and tracking.

This is by far the most common and easiest way to start taking payments online, hence, it is the reason why it is a fairly common feature available by many platforms including Payabl, GoCardless, Rapyd, and others.

Checkout

This option is particularly useful for any business taking payments online, be it a wholesale, e-commerce, agency, or even manufacturer.

Similar to payment links, it is a way for your customers to make payments online.

However, instead of a link that takes them to the Flywire page, they will be able to make payments directly on your website. After the payment has been completed, your customer will be redirected back to the website.

API

For especially large organizations needing custom solutions, Flywire offers an API to take full control over the payment experience.

ERP & CRM Systems

Flywire fully integrates into CRM, ERP, and accounting systems.

With this, your business can automate the reconciliation and send real-time notifications to your teams. Pair it with the API integration and you can build an enterprise-level payment system fully customized to your business.

Some of the systems Flywire integrates with include:

Certinia

Ellucian Banner/Colleague

Microsoft 365

Oracle systems

QuickBooks

Sage

Salesforce

SAP S/4HANA

Workday Finance

Xero

And more

Invoicing

Flywire offers a free invoicing tool for easy invoice processing and management.

This allows staff members to quickly generate invoices, and customers to make payments in one click. As well as you will get access to granular reporting.

Once the payments are made, the payment is automatically tracked and updated within the platform for easy reconciliation.

For more details on the products offered, use our guides below.

Signing up for Flywire

Go to Flywire

Visit Flywire's official website and navigate to the Sign-Up Page to create your account.

Fill Out Your Details

Fill in the details on the application form, including your name, email, address, and other required details.

Agree to the Terms & Conditions

Carefully read Flywire's terms of use and privacy policy. After reviewing them, tick the checkbox to indicate your agreement.

Create Your Account

Click on the "CREATE AN ACCOUNT" button to finalize your registration. You will receive a confirmation email shortly. Follow the instructions in the email to verify and activate your account.

Once everything is ready and verified, you will be able to manage and process the payments.

Companies using Flywire

Flywire has developed a set of tools and processes in the healthcare, travel, B2B, and education industries.

Education

Flywire created an end-to-end payment process for institutions to take payments and students to pay their fees.

Considering the high fees and poor rates offered by the banks, institutions are able to give a cheaper alternative for making payments. They have partnered with nearly 1,000 institutions within the US alone.

Institutions are able to create bills with reminders and deadlines for timely payments, provide self-service and interest-free payment options, automatically take local and international payments, as well as, provide flexible payment options for past-due payments.

There aren’t any other platforms of this size that are able to facilitate tuition payments to such an extent. If you are an institution, we would recommend using Flywire.

Healthcare

Travel

B2B

If you want to know more about the benefits of cross border payment solutions in these industries, have a look at the guides below.

.png)

.png)

.png)